georgia personal property tax exemptions

D Property which is held by a Georgia nonprofit corporation whose income is exempt from federal income tax pursuant to Section 115 of the Internal Revenue Code of 1986 and held. Exemptions Business Personal Property Personal property valued at 7500 or less is automatically exempt from ad valorem taxes.

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

To be granted a property tax exemption in Georgia you have to be the owner of the property from January 1 of that taxable year.

. Nonresidents that have real or personal property located in Georgia are. There are several property tax exemptions in Georgia and most. Georgia Merged Family-Owned Farms and Dairy and Eggs Tax Exemption Measure would expand certain property tax exemptions for agricultural.

Local state and federal government websites often end in gov. Almost all 93 percent of Georgias counties and over 140 of the cities have adopted a. Georgia has no personal exemption.

September 19 2022. The new tax law also eliminates the states marriage penalty with higher personal exemptions so married couples will no longer see more of their income taxed compared to. The property however must be returned valued.

All business personal property assets must be reported but some types of tangible personal property are not taxed including most types of automobiles trucks and other licensed. The Federal Income Tax however does allow a personal exemption to be deducted from your gross income if you are responsible for supporting. Property Tax Exemptions Page 6 Taxpayer Bill of Rights Page 11 Property Tax Appeals Page 13 Franchises Page 15.

Property Taxes While the state sets a minimal property tax rate each county and municipality sets its own rate. Georgia exempts a property owner from paying property tax on. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

The Georgia Personal Property Tax Exemptions Amendment also known as Amendment 14 was on the ballot in Georgia on November 3 1964 as a legislatively referred constitutional. To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000 and request a Summary of Benefits letter. Inventory Tax Exemption Business inventory is exempt from state property taxes as of January 1 2016.

Pay Property Taxes Property taxes are paid annually in the county where the. Georgia Individual Income Tax is based on the taxpayers federal adjusted gross income adjustments that are required by Georgia law and the taxpayers filing requirements. Items of personal property used in the home if not held for sale rental or other commercial use all tools and implements of.

Georgias companies pay no. Many Georgia counties and municipalities exempt local property tax at 100 for manufacturers in-process or finished goods inventory held for 12 months or less.

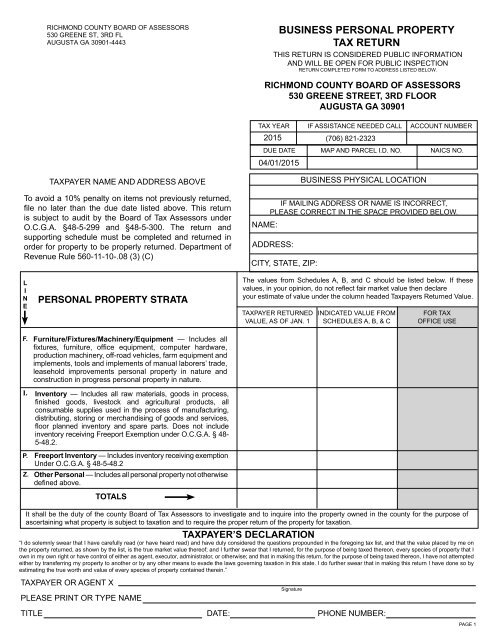

Business Personal Property Tax Return Augusta Georgia

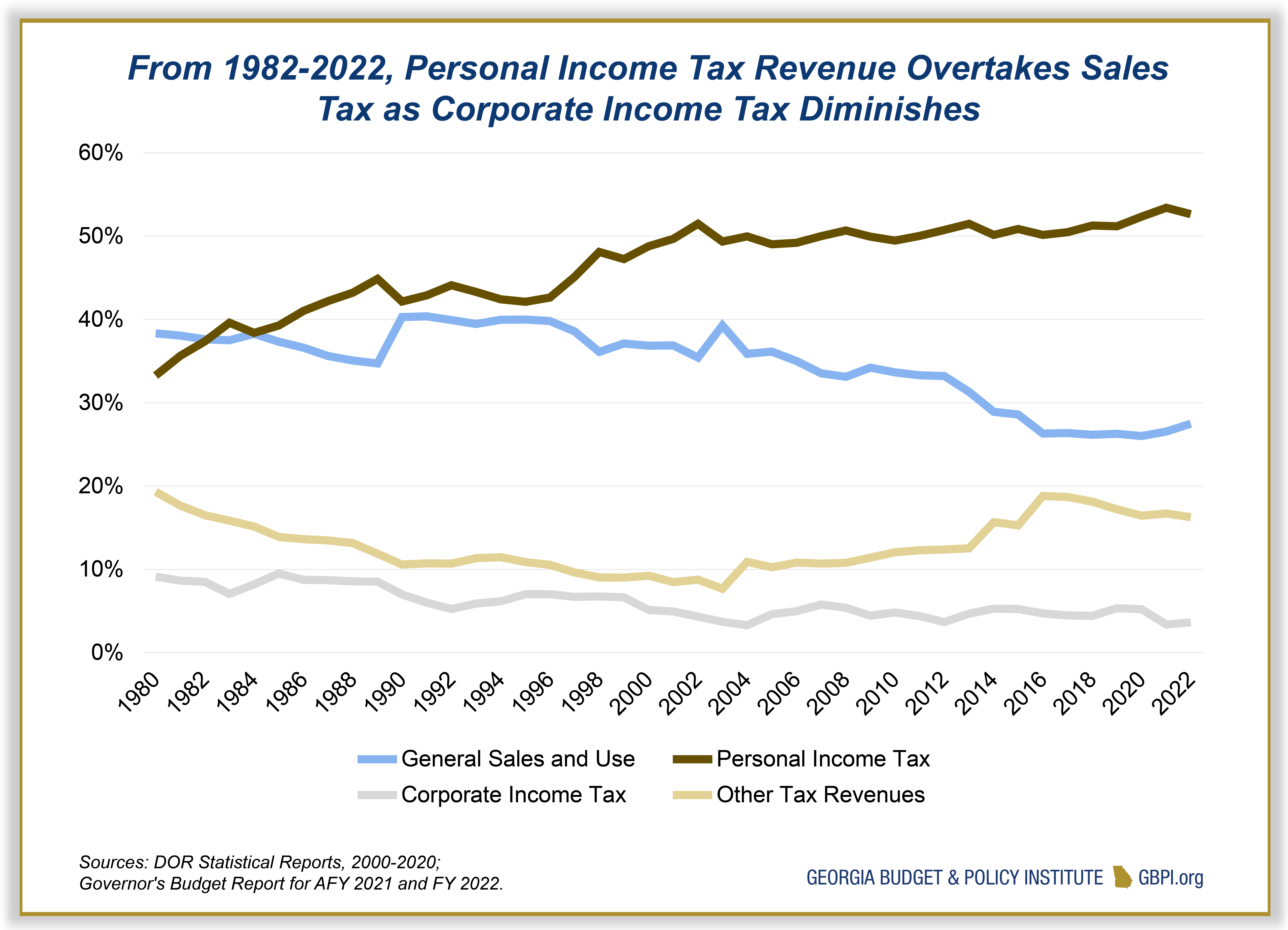

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

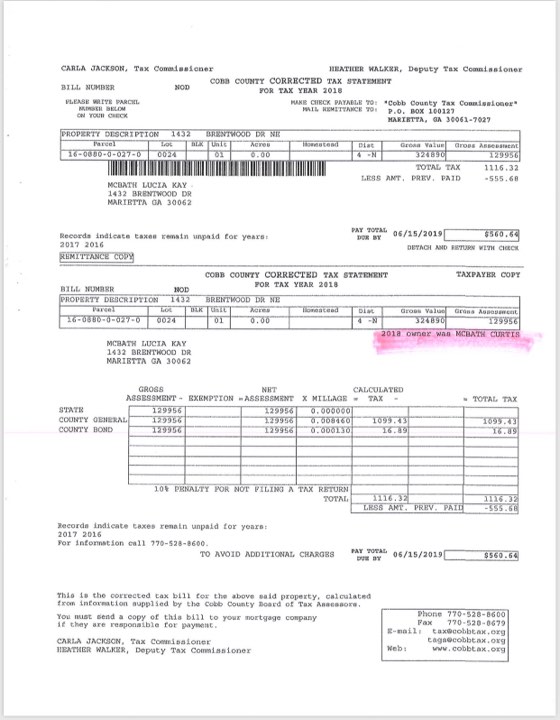

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

The Ultimate Guide To Property Tax Laws In Georgia

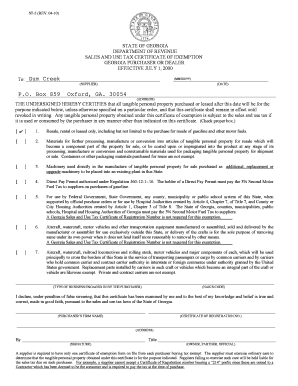

Fillable Online Georgia Dealer Tax Exemption Form St 5 Fax Email Print Pdffiller

Tangible Personal Property State Tangible Personal Property Taxes

Property Tax Dekalb Tax Commissioner

Form St 4 Fillable Out Of State Dealer Exemption Certificate Rev 12 01

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

2007 Sutherland Asbill Brennan Llp Introduction To Georgia Property Tax For Non Profits Charlie Kearns Sutherland Asbill Ppt Download

Polk County Georgia Tax Commissioner

States With Property Tax Exemptions For Veterans R Veterans

Form St Ch 1 Fillable Application For Certificate Of Exemption For Nonprofit Child Caring Institution Child Placing Agency And Maternity Home Rev 07 04

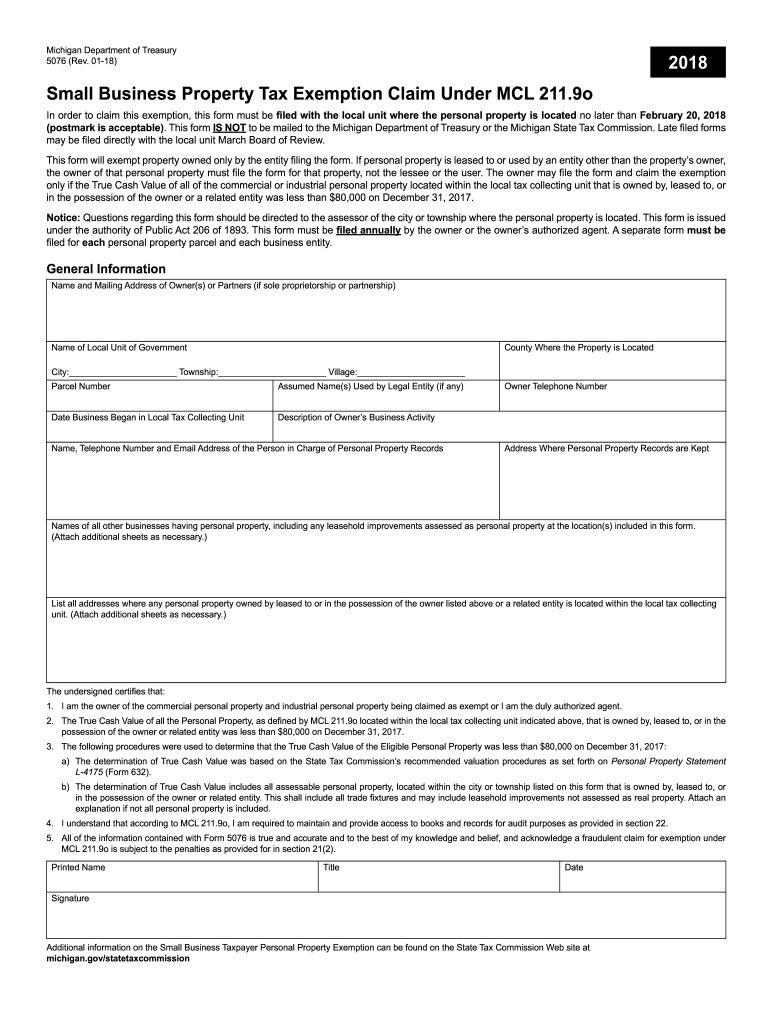

Small Business Property Tax Exemption Claim Under Mcl 211 Fill Out Sign Online Dochub

Georgia Sales Tax Small Business Guide Truic

Gsccca Org Pt 61 E Filing Help

What Is Homestead Exemption How To Reduce Property Taxes Georgia Taxes 2021 Property Taxes Youtube